Finally, if we assume that the company will not default over the next year, then debt due sooner shouldn’t be a concern. In contrast, a company’s ability to service long-term debt will depend on its long-term business prospects, which are less certain. If interest rates are higher when the long-term debt comes due and needs to be refinanced, then interest expense will rise.

How confident are you in your long term financial plan?

- The investor has not accounted for the fact that the utility company receives a consistent and durable stream of income, so is likely able to afford its debt.

- And, when analyzing a company’s debt, you would also want to consider how mature the debt is as well as cash flow relative to interest payment expenses.

- For companies that aren’t growing or are in financial distress, the D/E ratio can be written into debt covenants when the company borrows money, limiting the amount of debt issued.

- The debt-to-equity ratio (D/E) is a financial leverage ratio that can be helpful when attempting to understand a company’s economic health and if an investment is worthwhile or not.

In all cases, D/E ratios should be considered relative to a company’s industry and growth stage. A business that ignores debt financing entirely may be neglecting important growth opportunities. The benefit of debt capital is that it allows businesses to leverage a small amount of money into a much larger sum and repay it over time. This allows businesses to fund expansion projects more quickly than might otherwise be possible, theoretically increasing profits at an accelerated rate. A company’s management will, therefore, try to aim for a debt load that is compatible with a favorable D/E ratio in order to function without worrying about defaulting on its bonds or loans.

What Industries Have High D/E Ratios?

Restoration Hardware’s cash flow from operating activities has consistently grown over the past three years, suggesting the debt is being put to work and is driving results. Additionally, the growing cash flow indicates that the company will be able to service its debt level. The D/E ratio also gives analysts and investors an idea of how much risk a company is taking on by using debt to finance its operations and growth.

What Does a Negative D/E Ratio Signal?

A deeper dive into a company’s financial structure can paint a fuller picture. The debt-to-equity ratio can clue investors in on how stock prices may move. As a measure of leverage, debt-to-equity can show how aggressively a company is using debt to fund its growth. It is possible that the debt-to-equity ratio may be considered too low, as well, which is an indicator that a company is relying too heavily on its own equity to fund operations. In that case, investors may worry that the company isn’t taking advantage of potential growth opportunities. A debt-to-equity-ratio that’s high compared to others in a company’s given industry may indicate that that company is overleveraged and in a precarious position.

Financial Leverage

Like the D/E ratio, all other gearing ratios must be examined in the context of the company’s industry and competitors. If a D/E ratio becomes negative, a company may have no choice but to file for bankruptcy. And, when analyzing a company’s debt, you would also want to consider how mature the debt is as well as cash flow relative to interest payment expenses. As an example, many nonfinancial corporate businesses have seen their D/E ratios rise in recent years because they’ve increased their debt considerably over the past decade. Over this period, their debt has increased from about $6.4 billion to $12.5 billion (2).

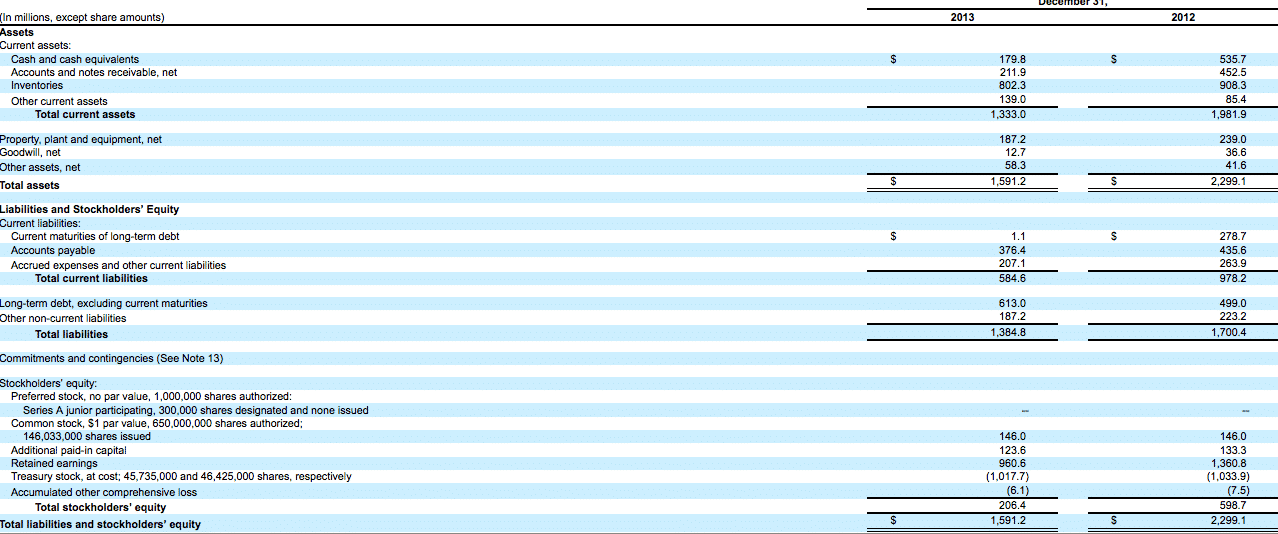

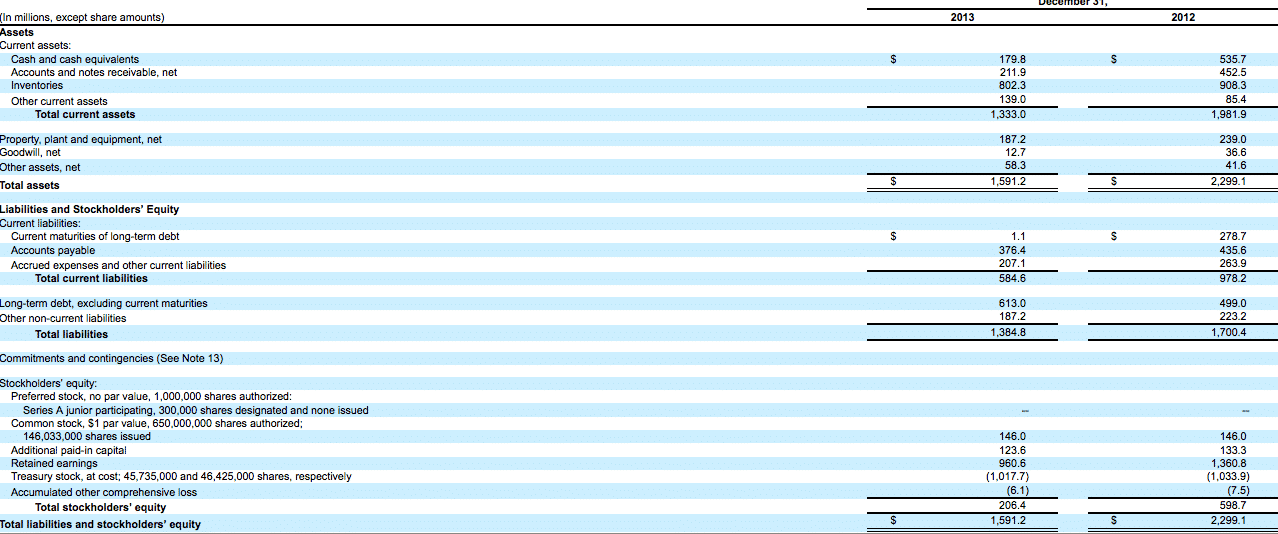

Let’s examine a hypothetical company’s balance sheet to illustrate this calculation. Understanding these distinctions is crucial for accurately interpreting a company’s financial obligations and overall leverage. The nature of the baking business is to take customer deposits, which are liabilities, on the company’s balance sheet. They do so because they consider this kind of debt to be riskier than short-term debt, which must be repaid in one year or less and is often less expensive than long-term debt. When interpreting the D/E ratio, you always need to put it in context by examining the ratios of competitors and assessing a company’s cash flow trends. As an example, the furnishings company Ethan Allen (ETD) is a competitor to Restoration Hardware.

The D/E ratio is one way to look for red flags that a company is in trouble in this respect. A D/E ratio of 1.5 would indicate that the company has 1.5 times more debt than equity, signaling a moderate level of financial leverage. A debt to equity ratio of 1 would mean that investors and creditors have an equal stake in the business assets.

Most of the information needed to calculate these ratios appears on a company’s balance sheet, save for EBIT, which appears on its profit and loss statement. To look at a simple example of a debt to equity formula, consider a company with total liabilities worth $100 million dollars and equity worth $85 million. Divide $100 million by $85 million and you’ll see that the company’s debt-to-equity ratio should you hire a bookkeeper would be about 1.18. These balance sheet categories may include items that would not normally be considered debt or equity in the traditional sense of a loan or an asset. A negative D/E ratio means that a company has negative equity, or that its liabilities exceed its total assets. A company with a negative D/E ratio is considered to be very risky and could potentially be at risk for bankruptcy.

The money can also serve as working capital in cyclical businesses during the periods when cash flow is low. The debt-to-equity ratio is most useful when used to compare direct competitors. If a company’s D/E ratio significantly exceeds those of others in its industry, then its stock could be more risky. Leverage varies by industry, as certain types of companies rely on debt more than others, and banks are even told how much leverage they can hold. Leverage ratios are most useful to look at in comparison to past data or a comparable peer group.

The main factors considered are debt, equity, assets, and interest expenses. We know that total liabilities plus shareholder equity equals total assets. Thus, shareholders’ equity is equal to the total assets minus the total liabilities. That is, total assets must equal liabilities + shareholders’ equity since everything that the firm owns must be purchased by either debt or equity. For a mature company, a high D/E ratio can be a sign of trouble that the firm will not be able to service its debts and can eventually lead to a credit event such as default.